5 Tips For Surviving Negative Cash Flow As A Real Estate Investor

As a real estate investor, the idea behind a negative cash flow can be quite daunting and may pose certain challenges, even to your portfolio.

However, there are certain ways to conveniently work your way around the occurrence of negative cash flow and significantly reduce the occurrence of low funds, poor sales, and even depreciation of the properties.

Here’s some insight on what negative cash flow is, how it can affect your portfolio, and some tips for surviving negative cash flow as a real estate investor.

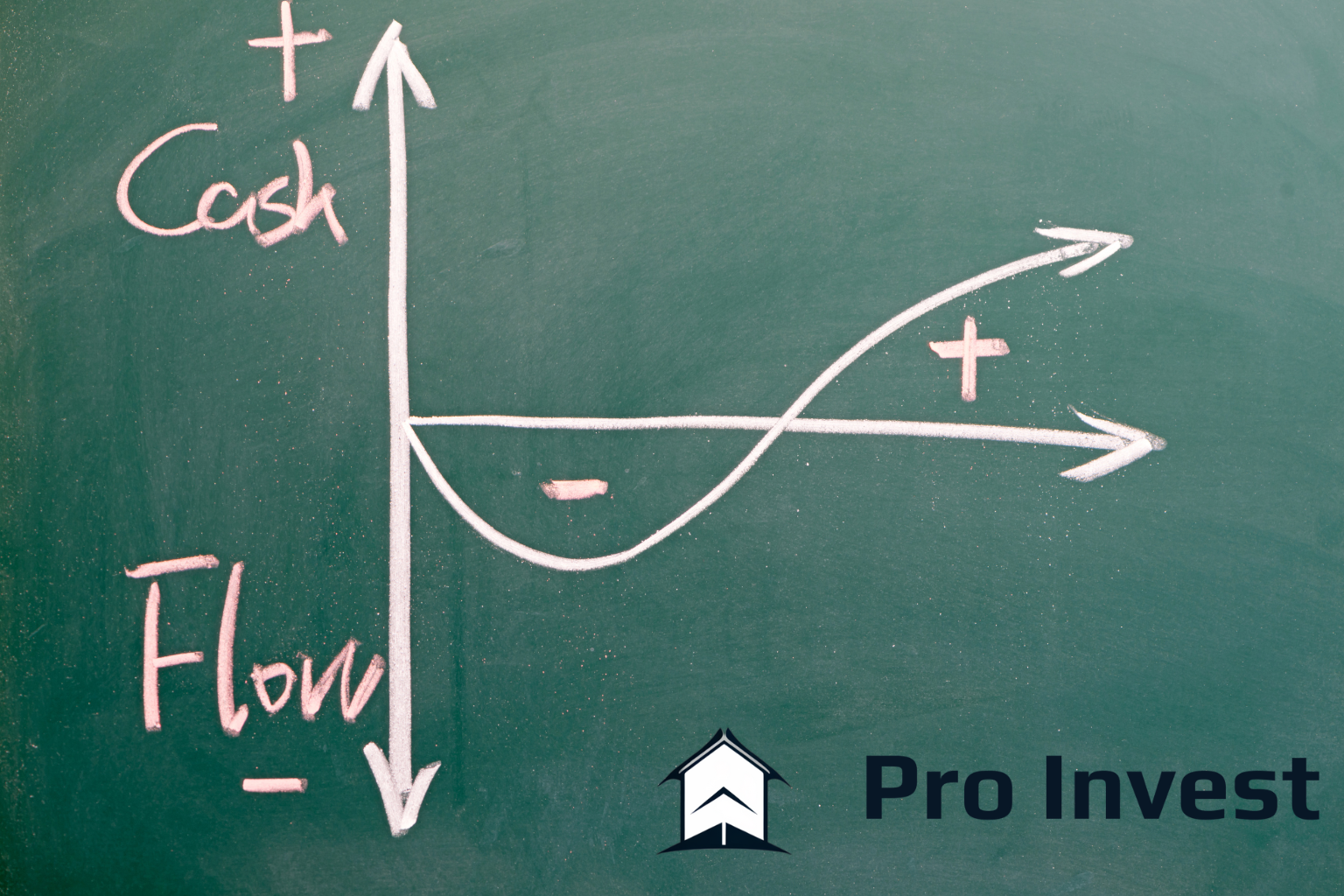

Negative Cash Flow

Negative cash flow in real estate simply refers to a situation where there’s an increase in the expenditure channeled into a property which could include maintenance fees, taxes, possible mortgage payments, utilities, insurance, etc, and a decline in the profit/rental income earned from a real estate investment or property.

In other words, the investor spends more money maintaining a property than he/she gains as profit. Hence, the term “negative cash flow” indicates less cash earned and more cash spent.

Helpful Tips For Surviving Negative Cash Flow As A Real Estate Investor

Ensure Proper Reevaluation Of Your Marketing Strategy

The first and major step in every business venture is the aspect of reevaluation, strategic analysis, and planning. In a case where you’re dealing with a negative cash flow, it would be advisable to review your marketing strategy and outline the areas that contribute to a low cash flow.

This includes the aspect of analyzing marketing strategy, identifying low cash flow areas, and planning for reevaluation.

Monitor Finance and Cash Flow

It is strongly advised to monitor the amount of money invested and the returns gained for every investment to properly track your cash flow and determine if it’s on the negative or positive side.

Also, ensure your medium of finance is sustainable enough for the procurement of properties. Moreover, aim to secure better and feasible loans at lesser rates that will be friendly to your finances.

Be sure to seek financial advice from banks and professionals on the type of loan suitable for you. Lower payments for longer periods are usually advised compared to higher payments for shorter periods. This way, you’re able to meet up with your loan payments and still be able to work your way around making profits and sustaining your business.

Check Your Marketing Strategy

Marketing strategy revolves around the idea behind rental prices and increasing rents. This helps to mitigate the cost of expenses used in property management, taxes, insurance, etc. However, be sure to raise the rental prices reasonably to avoid scaring off potential tenants.

In addition, negative cash flow due to poor financing can also be lessened with the option of examining lease/ tenancy agreements to include payment for certain repairs and amenities. This creates a sense of inclusion, reduces costs, and should be done at the notice of the tenants.

Be Prepared For Uncertainties And Seek Help When Necessary

The idea of this is to have possible liquid assets or savings that could help in cases of uncertainties. After proper evaluation and you notice a lasting occurrence of negative cash flow, your savings or cash reserve might come in handy.

Most importantly, it is advisable to seek financial assistance and help from professionals especially those in the field of real estate investments.

Consider A Joint Investment / Venture

One of the most effective tips for surviving negative cash flow as a real estate agent is to consider joint real estate partnership(s). That way, the financial burden is lessened and it becomes easier to contribute your quota in sustaining the property investments without being affected by losses like a negative cash flow.

Moreso, it creates room for partnership, division of labor, and an easier management system for your properties.

Can Negative Cash Flow Affect Your Portfolio?

Negative cash flow as the name implies, does have negative impacts on your portfolio as a real estate investor. Some of these demerits are;

Fiscal constraints

The concept behind negative cash flow implies that the investor stands the risk of having little to no gains by channeling more capital into property management and maintenance than the actual profit he or she gains from the rental income.

Moreso, if there’s a consistent loss of funds, it can lead to further problems for the investor such as:

- Procurement of possible debts used to upset loans.

- The possible shutdown of the investment agency if there are no visible results or profits earned.

Trouble Diversifying And Exploring Other Investment Options

As a real estate investor, a negative cash flow can pose difficulty in diversifying or exploring other investment options you may want to venture into. In most cases, most investors would have little to no capital or resources to invest in new prospects.

Depreciation Of Properties And Risk Of Bad Sales

One of the major demerits of a negative cash flow on a real estate investor’s portfolio is the possible risk of having no sale of properties or difficulty finding buyers who can meet up with the rental prices. In such cases, properties might stay vacant for a longer period and possibly lead to low demand as the property ages or is below par.

It can also contribute to bad sales which provide no returns and possibly discourage lenders from lending capital to help ease the financial burden associated with a negative cash flow.

Conclusion

Cases of negative cash flow may not always seem to be detrimental, however, it is safer and more convenient to handle properties that produce positive cash flow and profit.

Additionally, it’s usually safer to just deal with positive cash flow properties that are easier to handle and more profitable to manage. Positive cash flow properties provide more rental income that exceeds the amount put into investing. This means lower investment/ maintenance costs and more profits on the part of the investor.

Need To access positive cash flow Properties that are more promising? Check out NY Properties. They help you navigate cash flow properties by providing you with the best options for maximum profit.